How Do I Change My Name in Florida?

How Do I Change My Name in Florida?The process of changing your name can be overwhelming and confusing. It’s always helpful

Will the Federal Trade Commission Ban Non-Competition Clauses?

According to a press release by the Federal Trade Commission (FTC) on January 5th, the agency is considering a new rule

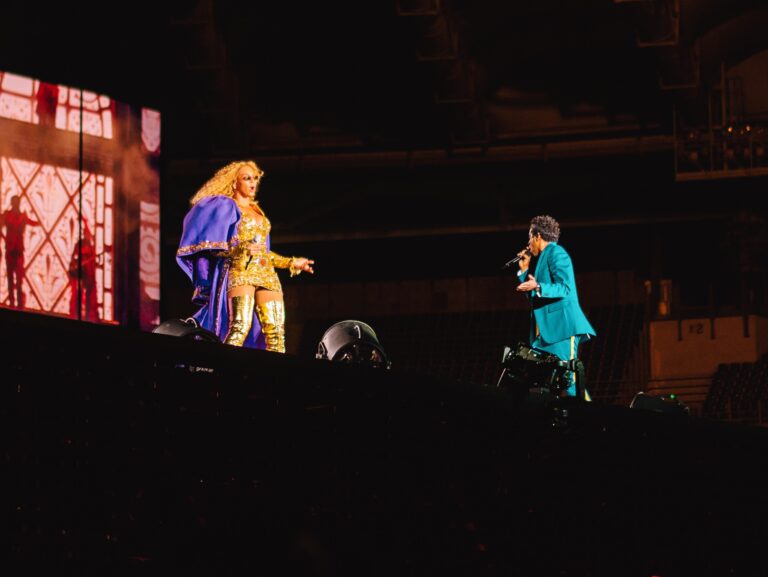

What Are International Publishing Royalties?

Performance royalties are an important source of income for talented music artists. International publishing royalties permit artists to collect and forward

New Data Privacy Laws to be Aware of in 2023

Until 2023, American privacy laws have differed substantially from the European approach to privacy. Traditionally, the American mindset to privacy has

How Important is Estate Planning for College Students?

Heading off to college is a thrilling time for students and their families alike. It’s a period full ofendless possibilities, newfound

Department of Labor Anticipated to Restrict Independent Contractor Definition in 2023

The U.S. Department of Labor (DOL) has issued a new rule proposal that would significantly alter how employers nationwide can classify

What is Legal Compliance in e-Commerce?

Important E-Commerce Compliance Every Business Needs to Know: What are e-commerce agreements? E-commerce agreements are contracts that include the terms for

How Employers can Participate in Tuition Reimbursement and Student Loan Repayment Programs

In the dynamic landscape of today’s job market, employers are recognizing the value of investingin their employees’ education. Not only does

How Your Child Can Grow Tax-Free Wealth: A Step-by-Step Guide

As a parent, you want to set your child up for financial success in the future. One excellent way to do

What is a Consumer Cooperative?

What is a consumer cooperative? A consumer cooperative is a business model that is owned and controlled by its members; where

Categories

Categories

- Bankruptcy (6)

- Business Law (381)

- Business Litigation (34)

- Business Partnership Disputes (8)

- businesses (7)

- CBD Law (1)

- Civil Litigation (58)

- Commercial Law (2)

- Consumer Protection (7)

- Contract (24)

- copyright (11)

- Corporate (6)

- COVID-19 (35)

- Cryptocurrency (5)

- Documentary Stamp Tax (2)

- Employment Law (73)

- Entertainment Law (80)

- EPGD Business Law (35)

- Estate Planning (78)

- Family Law (18)

- Federal Law (8)

- Finance (15)

- Florida Law (20)

- Florida Minority Business Government Programs (2)

- Foreign Investing (3)

- Foreign Reporting (10)

- Franchise Law (17)

- Fraud (2)

- Government (15)

- Homestead Exemption (9)

- Immigration Law (8)

- Intellectual Property Law (94)

- Landlord / Tenant (8)

- LegalZoom (1)

- Licensing Agreement (1)

- Litigation (11)

- NFT (4)

- Notarization (2)

- Patent (2)

- Privacy Law (9)

- Probate & Guardianship (24)

- Property Law (10)

- protection (5)

- Real Estate Law (66)

- security (7)

- Tax Law (116)

- Testamentary Trust (1)

- trademark (14)

- Transactional (19)

- Trusts & Estates (52)